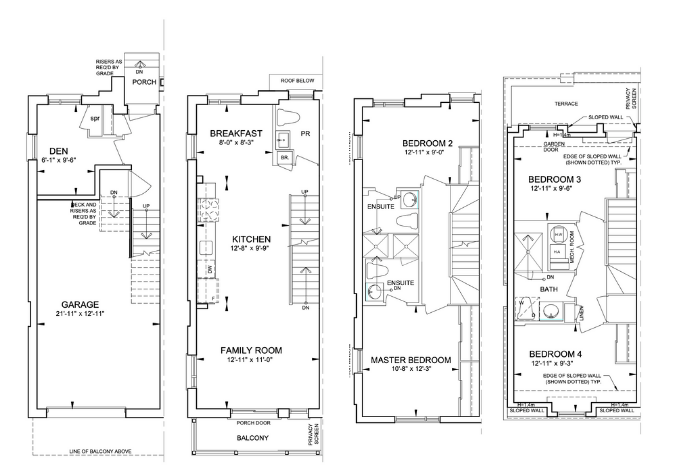

Hello home! This glorious detached home is drenched with sun and charm in Prime South Ajax. In the highly coveted Carruthers Creek neighbourhood this stunning family home is over 2800 sq ft of total living space featuring 3 generous-sized bedrooms, 4 bathrooms, an eat-in kitchen with quartz countertops and pantry. Functional finished basement allows for loads of storage. Large and well maintained backyard perfect for entertaining. Driveway fits 2 cars with no sidewalk. Close to 401, parks, schools, GO train, shopping and Lake Ontario via Paradise Beach.

List Price: $929,000

Address: 30 Angier Cres

Bedrooms: 3

Washrooms: 4

Extras: Stainless Steel Refrigerator, Stove, Hood Range, Dishwasher, Washer And Dryer, All Electrical Fixtures, All Window Coverings, Built-In Bookcases In Living Room, Ecobee Thermostat

Link to brochure: 30 Angier Cres – Brochure