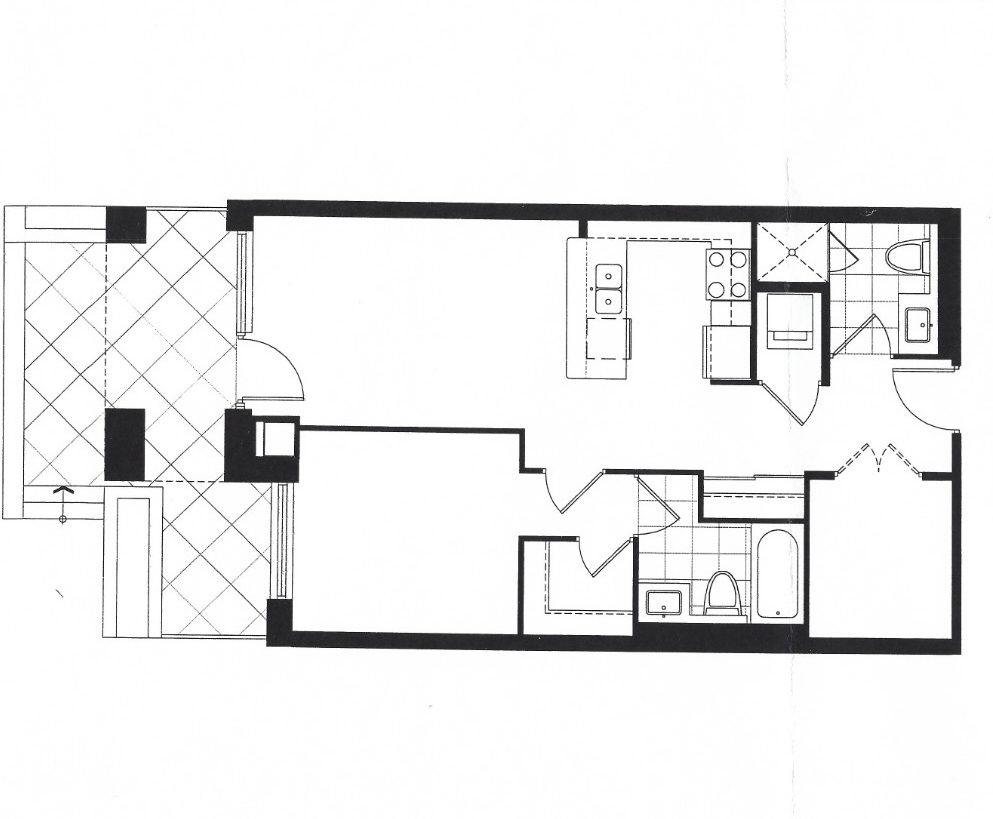

Bright And Beautiful 1 Year Old Empire Built 3 Bedroom Detached Home In A Very Prestigious Neighbourhood. Move-In Ready With Stainless Steel Appliances And Open Kitchen. Upgrades Spent $$$. Over 2000 Sq Ft – One Of The Best Floorplans. New Subdivision With Lots Of Amenities Including Community Centre And Parks. Conveniently Located Minutes From Hiking Trails, Groceries, Schools, Parks, And More!

Address: 124 Longboat Run W

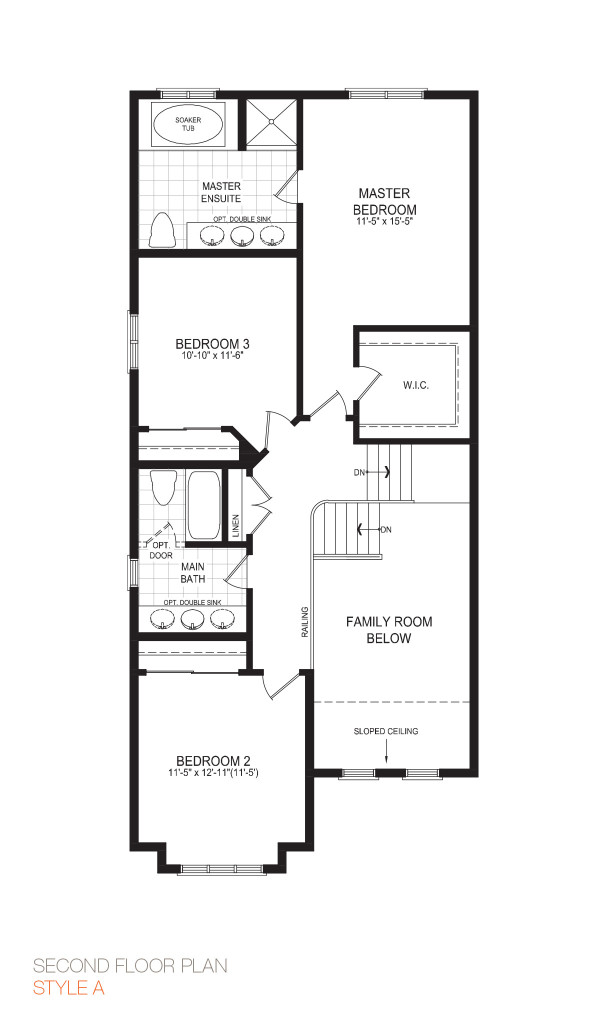

Bedrooms: 3

Bathrooms: 3

Lot Size: 30.18 x 91.86 Feet

Property Tax: $4,505.67

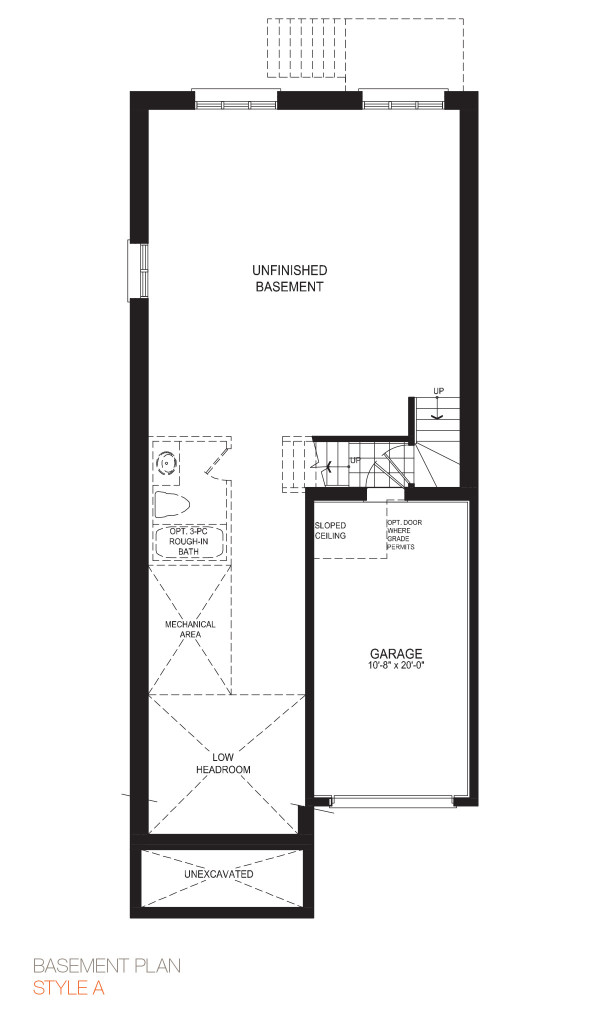

Parking: Single Car Garage + 1 Driveway Space

Extras: Stainless Steel Refrigerator, Stove, Dishwasher, Hood Range, Washer And Dryer, All Electrical Light Fixtures, All Window Coverings, Water Softener, Air Conditioner, Furnace, Fully Fenced.