Welcome To This Rarely Found 70′ Frontage 3-Car Garage Detached Home In The Esteemed Cachet Community! This Greenpark Built Home With Original Owners Is A True Gem. Its Prime Location Is Near Highly Regarded Schools (Pierre Elliot Trudeau/Unionville High/St Augustine) & Boasts Numerous Desirable Features: Four Generously Sized Bedrooms, Oak Staircase, Bright Home With Tons of Natural Light, New Roof (’21), New Furnace (’22), New AC (’22), Main Floor Laundry / Mudroom Provides Easy Access To Garage & Backyard, Beautiful Garden. Perfect For Families Or Multi-Generational Living. Mins To Hwy 404, T&T Supermarket, Parks And More!

List Price: $1,988,000

Address: 2477 Rodick Road

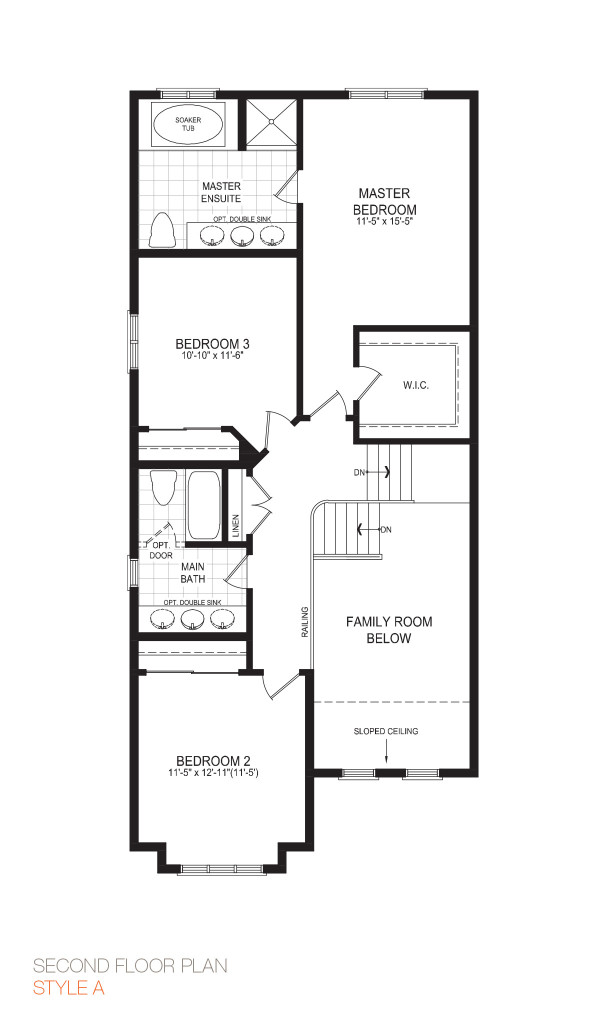

Bedrooms: 4

Bathrooms: 3

Parking: 7

Refrigerator, Stove (As Is), Dishwasher, Washer, Dryer, All Window Coverings, All Light Fixtures, Garage Door Opener (As Is), Central Vacuum.